capital gains tax news canada

When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada.

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

If the gain is 50 percent higher than the marginal tax rate then the tax must be paid on the gain.

. 7 hours agoTaxing those gains discourages investment at a time when Canada is already struggling to attract capital and trying to figure out how to boost productivity. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. When Is a Capital Gain Subject to Tax.

Liberal Leader Justin Trudeau has repeatedly denied. It was then increased to 6667 per cent in. The amount of tax youll pay depends on how much youre earning from other sources.

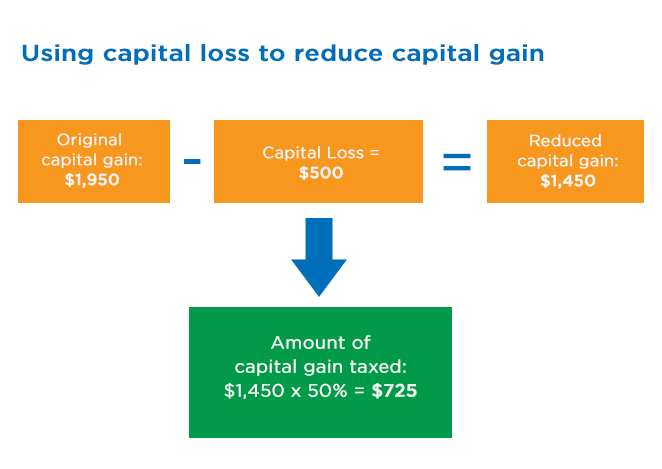

The two are combined and the net gain or loss shows on line 15. Candidates and their political parties are proposing several changes to the current tax schemes. Capital gains are part of the taxpayers comprehensive income and in a fair and efficient tax system they should be subject to taxation just like other income.

You can however exclude up to 250000-500000 from. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. A Canadian capital asset includes 50 in Canadas capital gains tax when it is sold for more than its purchase price in excess of its estimated purchase price meaning there are taxes on 50 of the capital gains.

But in Canada today only 50 per cent of realized capital gains are included in taxable income meaning the effective personal tax rate on these gains is only half that of other income. The Chrétien and Martin Liberals reduced the capital gains inclusion rate the amount of capital gains subject to tax from 75 to 50 as part of a larger initiative to improve Canadas competitiveness and attractiveness to investors. Canada has a tax on capital gains of 50.

He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. Unlike in Canada the US. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

They taxed me on 50 of my earnings capital gains at a 2697 rate or roughly 135 on everything overall and im trying to figure out this have was normal or really high and what everyone is paying. Will not consider you exempt from capital gains tax when you sell your principal residence. In Canada 50 of your capital gains are taxable.

The MEI research paper lays out a. In Canada 50 of the value of any capital gains is taxable. And the tax rate depends on your income.

For example on a capital gain of 10000 half of that or 5000 would be taxed based on the individuals tax bracket and the province of. Well be watching closely. In case you sell the investments at a higher price than you paid for them realized capital gain half of the capital gain will need to be added to your income in order to qualify for tax benefits.

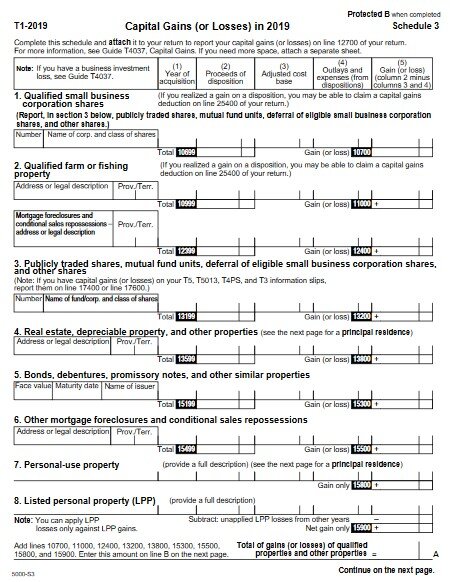

The sale is reported on form 8949 and transfers to line 10 of Schedule D. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The Long-term capital loss carryover shows on line 14 of Schedule D.

If TurboTax is not picking up your loss form last years return you have to enter it manually at. From 1972 to 1988 Canadians had. The capital gains tax rate in Ontario for the highest income bracket is 2676.

In this article we outline the history of capital gains taxation in Canada describe some of the key features of the current system and comment on potential reforms. So out of the 30000 profit you made from selling you would have to report 15000. Canadas capital gains tax was introduced in part to finance the growing costs of Canadas social security system and to create a more equitable system of taxation.

You must pay taxes on 50 of this gain at your marginal tax rate. Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. So if anyone else has any experience with cryptocurrency taxes in Canada and what percentages youve been taxed at before or for 2021 id really appreciate the help.

Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen. Now that youre aware of how the Canada Capital Gains Tax and Attribution Rules from the CRA Canada Revenue Agency work lets look at how they function in the US. In our example you would have to include 1325 2650 x 50 in your income.

According to the report the federal government would institute a 02 per cent levy for homes valued between 1 million and 15 million and up to one per cent of residential properties valued north of 2 million. Conservative Leader Erin OToole is accusing the Liberals once again of planning to impose a capital gains tax on people who sell their homes. One idea was a home equity tax on properties valued at 1 million and more.

The New Democratic Party NDP in. Study authors forecast the average annual surtax would.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Pay Less Tax On Your Capital Gains The Independent Dollar

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Reporting Capital Gains Dividend Income Is Complex Morningstar

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

What Is The Current Capital Gains Tax Rate In Canada Ictsd Org

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Reporting Capital Gains Dividend Income Is Complex Morningstar

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Can Capital Gains Push Me Into A Higher Tax Bracket

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Is Capital Gains Tax Calculated On Real Estate In Canada Srj Chartered Accountants Professional Corporation

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada